H.R. 9495 Is a Five-Alarm Fire for Nonprofits

"#1. Do not obey in advance.

Most of the power of authoritarianism is freely given. In times like these, individuals think ahead about what a more repressive government will want, and then offer themselves without being asked. A citizen who adapts in this way is teaching power what it can do."

From On Tyranny by Timothy Snyder

All hands on deck, folks. If you live in the U.S. and work at, or care about, nonprofit organizations, it is time to call your House rep first thing on Monday morning (and Tuesday and Wednesday, if necessary) in order to protect the GOP from granting Trump sweeping revenge powers that could completely shatter the entire nonprofit sector.

Yes, really.

You may or may not have seen this in the news, but a bill was sent to the House floor last Tuesday which would essentially have granted the Trump administration the power to direct the IRS to take away 501c3 tax-exempt status from "un-American" nonprofits. H.R. 9495, the "Stop Terror Financing and Penalties on American Hostages" Act, started out as an objectively good thing which already passed the Senate on its own, and which Biden was ready to sign. (Did you know that you're still subject to IRS tax penalties if you are a U.S. citizen who is taken hostage by terrorists??? Because I did not, and that seems like something we should fix!)

However, the House GOP added a new clause to this bill's language which would grant the Treasury Department the ability to deny tax exemption to any nonprofit they deem to be "supporting terrorism." The bill does claim that you'd be notified if you made the list, and given 90 days to appeal it, but the ACLU describes this as "a mere illusion of due process. The government may deny organizations its reasons and evidence against them, leaving the nonprofit unable to rebut allegations. This means that a nonprofit could be left entirely in the dark about what conduct the government believes qualifies as 'support,' making it virtually impossible to clear its name."

The House voted on H.R. 9495 on November 12th, and fortunately it failed to secure the 2/3rds majority it needed; but they're immediately trying again, which should worry us. On Monday it goes to the Rules Committee for a hearing in which members may approve or disapprove and propose amendments. If it passes the committee, it will come back to a full floor vote on Wednesday. This time, it will only need a simple majority. (The Intercept has several good articles on this, one from last week here and one about the upcoming attempt here, which go into more detail on the goals of this bill and why it's scary.) They attempted to ram this same bill through in September as well. The ACLU and a diverse array of over 130 other tax-exempt organizations — including human rights, reproductive health, and immigrants’ rights groups — wrote to Congress urging them to vote no. (That letter is here, and is worth reading in full.) The persistence is the most alarming part of this; Trump wants this very, very badly, and we cannot give it to him or all of us are screwed.

52 Democrats voted in support of H.R. 9495 last week; the House clerk's roll call is here, so you can look up your rep and see how they voted. (For those of you in Oregon, the vote was split along party lines; the Democrats - Bonamici, Blumenauer, Hoyle and Salinas - voted Nay, while the Republicans, Bentz and Chavez-DeRemer, voted Yea.) But even if your rep voted against it, please contact them anyway. My rep is Suzanne Bonamici, and I was really disappointed in the response I received from her, which included the line "The bill would have also suspended the tax-exempt status of any nonprofit organization that has given material support to a terrorist organization." This isn't true. It would suspend the tax-exempt status of any nonprofit organization that Donald Trump claims has any connection at all to "un-American activities," defined however he wants.

And if your first thought is, "well, that sucks hugely for the Southern Poverty Law Center, but we're tiny, what are the odds of us ever coming to the attention of the Treasury Department," think about every snitch hotline red state governors have ever set up inviting citizens to call in and rat out their neighbors or local schools and businesses. Think about what's happening right now in our schools and libraries with book bans and LGBTQ teachers getting fired. No one is safe from this. Even if I only consider the small circle of nonprofits that I currently write grants for, there's one company with a documentary film series highlighting the stories of immigrant families in East Multnomah County, and another who produced an opera about the Central Park Five. Is that enough to get them reported to some hotline by a Trump supporter angry about Portland being too "woke"? I don't know, and that's the problem. None of us can know.

Every nonprofit I know is still picking themselves back up after years of COVID-related revenue losses, restructuring and rebuilding and trying to find their new normal. Losing access to tax exemption, and all the fundraising which comes with it, is an existential threat to our entire sector . . . not to mention the horrifying impacts it will have on the people who depend upon us for the services we offer. Ad as Snyder points out; the dangers here are both direct and indirect; even organizations who are never explicitly targeted may fold under the pressure to abandon their support for marginalized communities and progressive causes for fear that they'll be next. Will theatres stop producing any work by Palestinian artists or telling the stories of immigrants? Will social service nonprofits quietly remove their services for trans people? Will we all start telling ourselves that a little bit of moral compromise here and there to keep our heads down is better than getting in trouble with the Trump administration and being forced to shut our doors? The only way to avoid ending up facing that awful choice is to make it clear to Congress that this bill is a losing proposition every single time it comes up.

Please call and thank your House rep if they voted nay, and implore them to continue to do so. If they voted for it, please call and tell them exactly how it would harm your organization if you were to lose your tax exemption. There are scripts below, but I encourage you to be honest and share your own stories. If your Congressional leaders are Republican and you haven't found them responsive to phone calls in the past, it might be worth trying to come at it from a sideways angle; for example, Cliff Bentz of Oregon's 2nd Congressional District, which contains the city of Ashland (home of the Oregon Shakespeare Festival), might not care very much about the argument that this bill could have a chilling effect on OSF's artistic programming, but it's possible he might care about the fears of small business owners in Ashland who are hugely dependent on the theatre's 100,000 audience members per year to stay afloat. Your red state senator might be completely fine with kicking out the local LGBTQ health clinic; but they might care about not getting to take their grandkids to The Nutcracker ever again because the ballet employs dancers on work visas from China and maybe someone at Trump's Treasury department decides that's evidence enough.

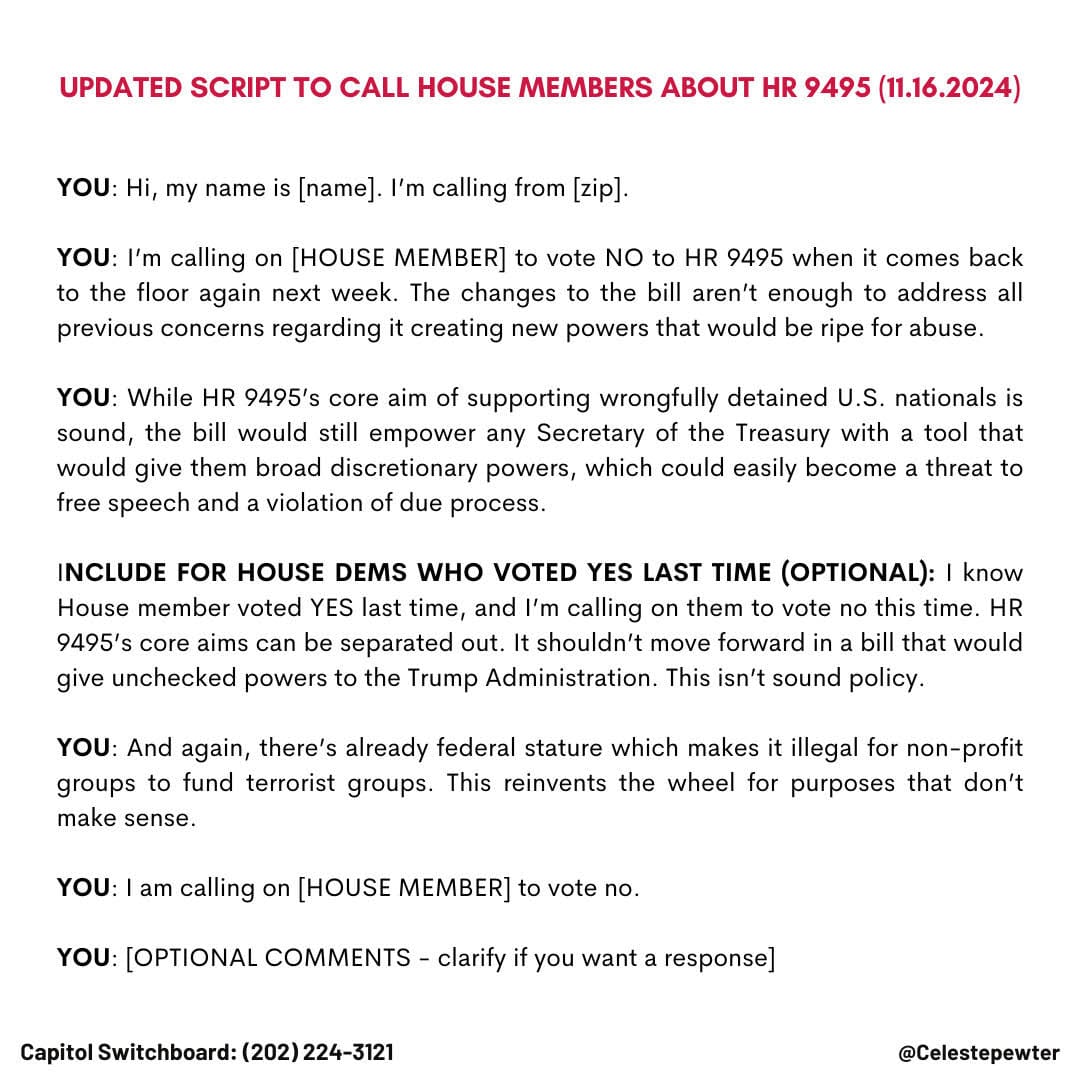

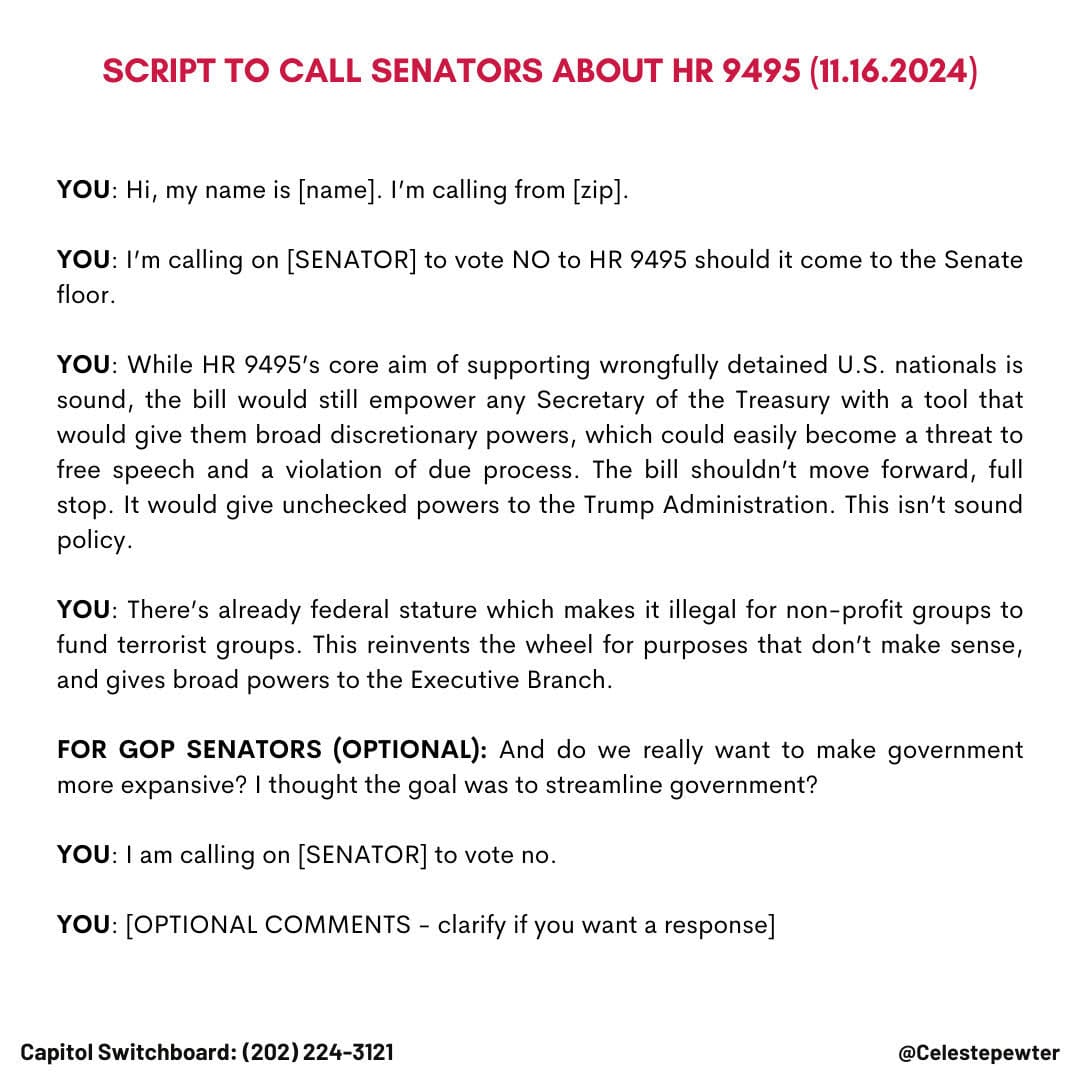

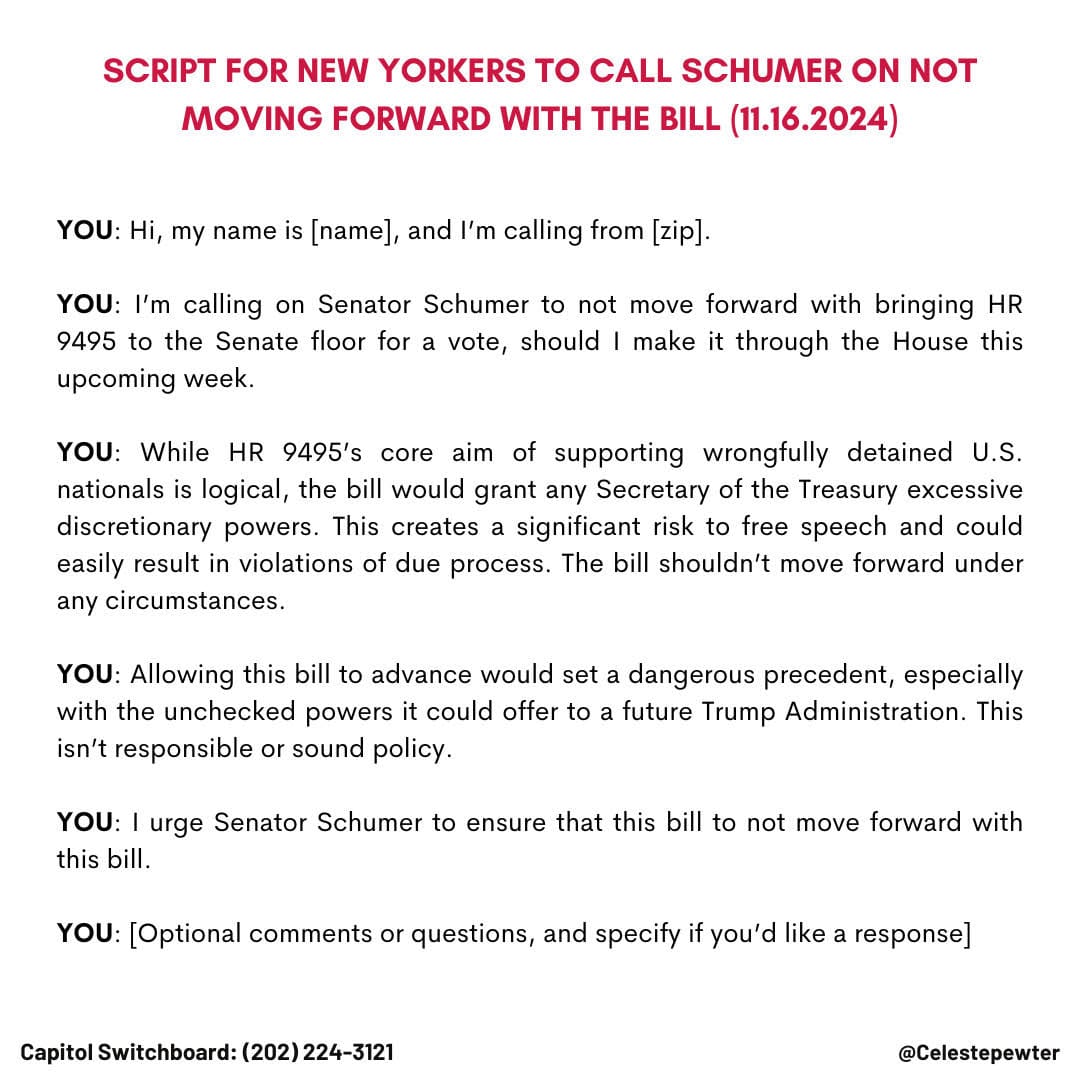

I've attached three scripts below, which were created and shared by former Dem staffer Celeste Pewter; one is for House reps, one is for Senators, and one is specific to New Yorkers for Senate leader Chuck Schumer.

I'm pissed and I'm scared, and you probably are too; but the nonprofit sector wields a huge amount of influence in the U.S. and we are everywhere, in every town and city, every county, every state. There's never been a more important time for us to stand together and protect each other.

Member discussion